Tax Return

Filing a tax return electronically

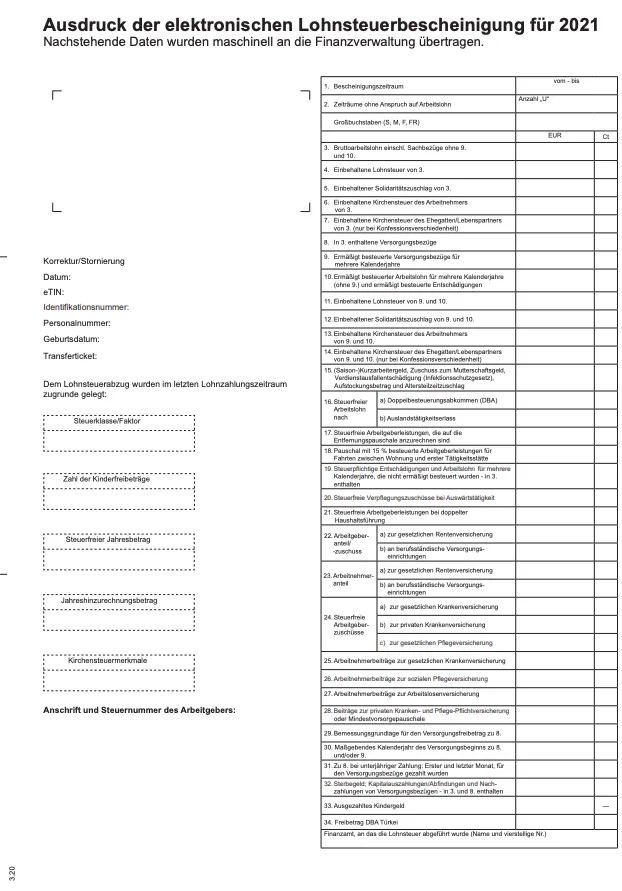

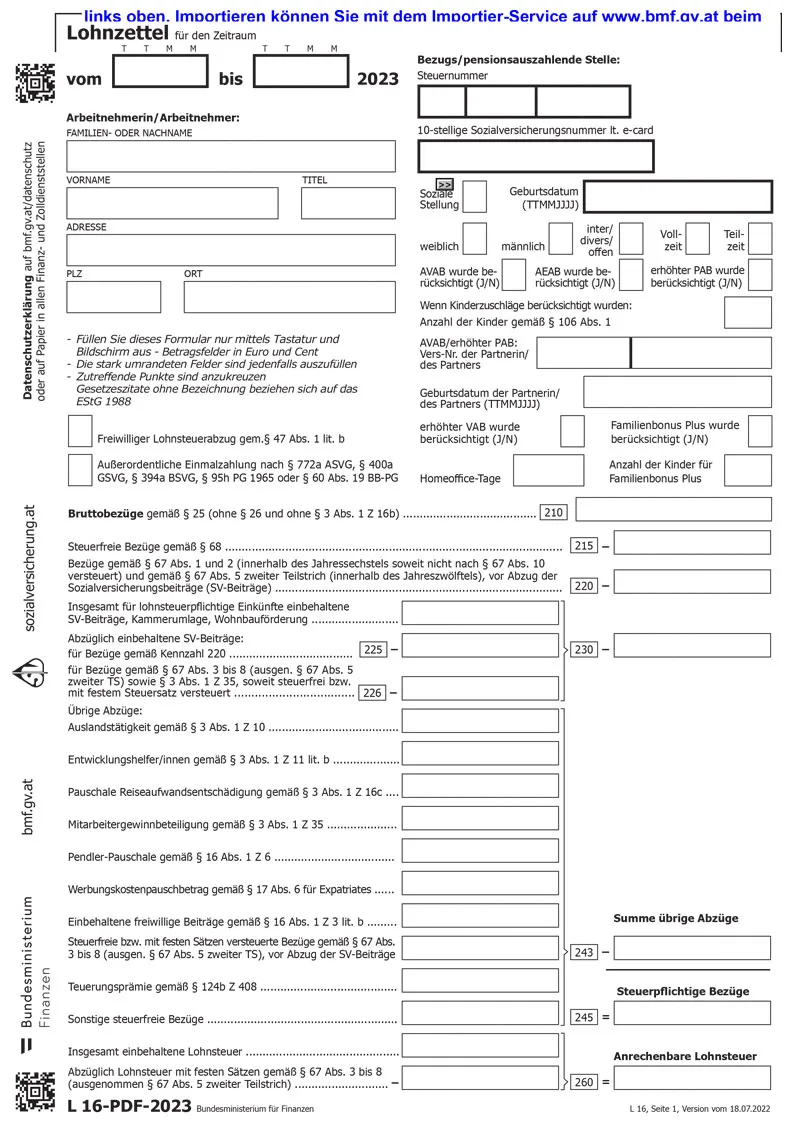

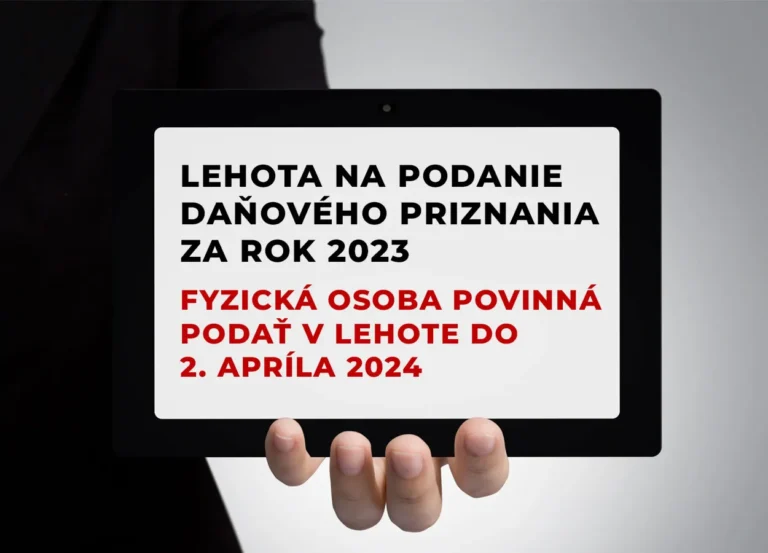

Processing and submission of the tax return for personal income tax 2024 (for the year 2023) in the Slovak Republic. Electronic processing and submission.

The online tax return is intended for employees, part-timers, self-employed, pensioners, nannies, for those who rent real estate and of course for all those who do not know how to deal with tax returns. Fast, simple and convenient tax return processing from the comfort of your home. Postponement of tax return online in Slovakia.

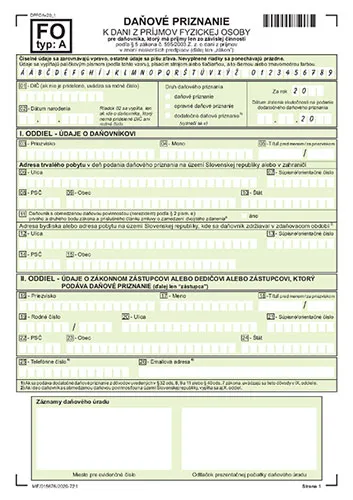

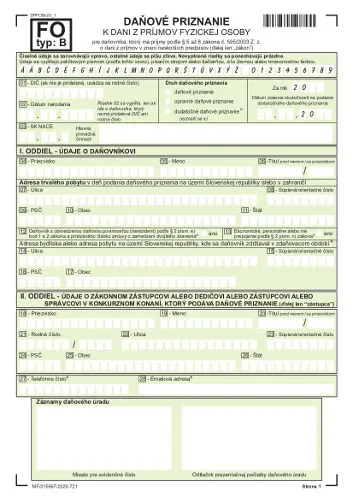

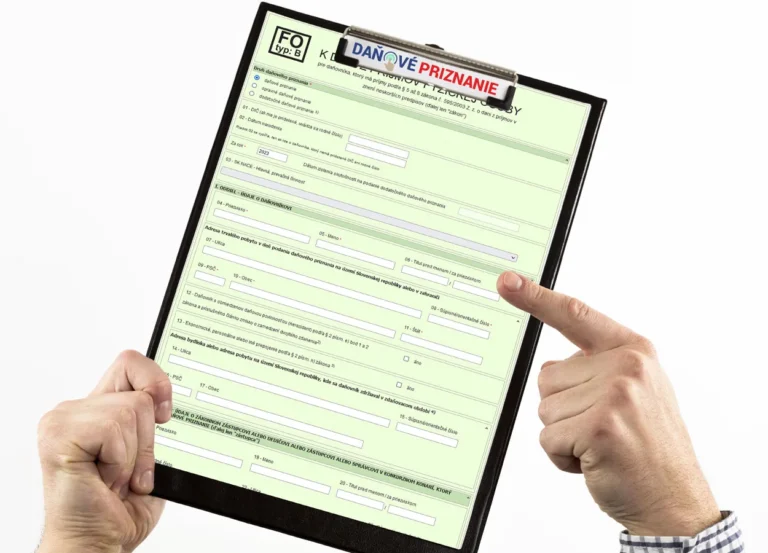

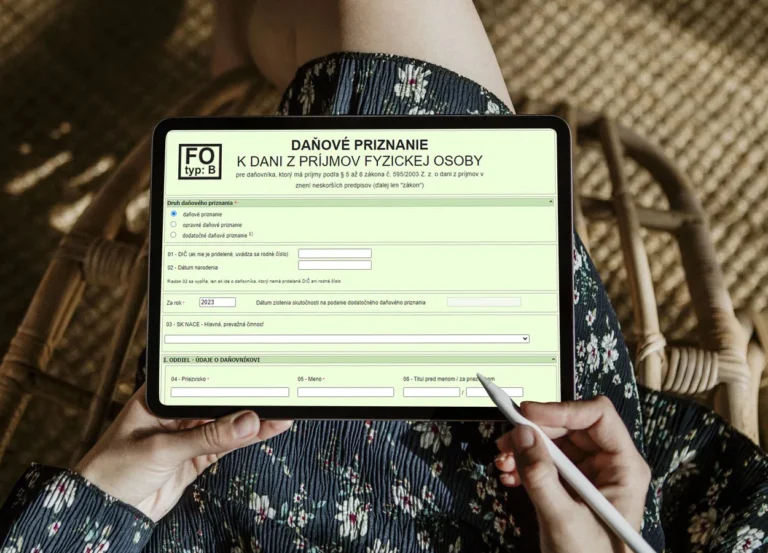

Tax returns type FO type A or FO type B for the year 2023 Slovak Republic are prepared by a certified tax advisor, unlike online applications that cannot advise you or check the correctness of the filled-in data and ensure the correct preparation and submission of the tax return. You can print the tax return yourself and send it to the tax office in person, by post, or we will file it electronically for you at the Financial Office of the Slovak Republic. Process your tax return in the Slovak Republic for the year 2023 in an online form.

Completing the form for the online SR tax return

Our clients

Employment in Slovakia, self-employed + other income – Refund of taxes from abroad

Slovak Republic tax return

Processing and submission of the tax return

Employment in Slovakia, self-employed + other income

- Are you an employee, self-employed person, lawyer, intermediary and need to file a tax return?

- Easy application of tax bonus and other deductible items

- Did you rent an apartment, did you sell the property?

- Are you a caregiver or do you have income from personal assistance?

- Income from capital assets and virtual currency

- The possibility of electronic filing of the tax return

- Thousands of tax returns prepared online

Tax return and tax refund from abroad

Refund of taxes from abroad

- Have you worked abroad and need help with your tax refund?

- We will file a return for natural persons and help you return tax from abroad.

- We will send the foreign tax return for you and you don’t have to worry about anything.

- We will provide or help with the preparation of all the necessary documents for filing a tax return abroad.

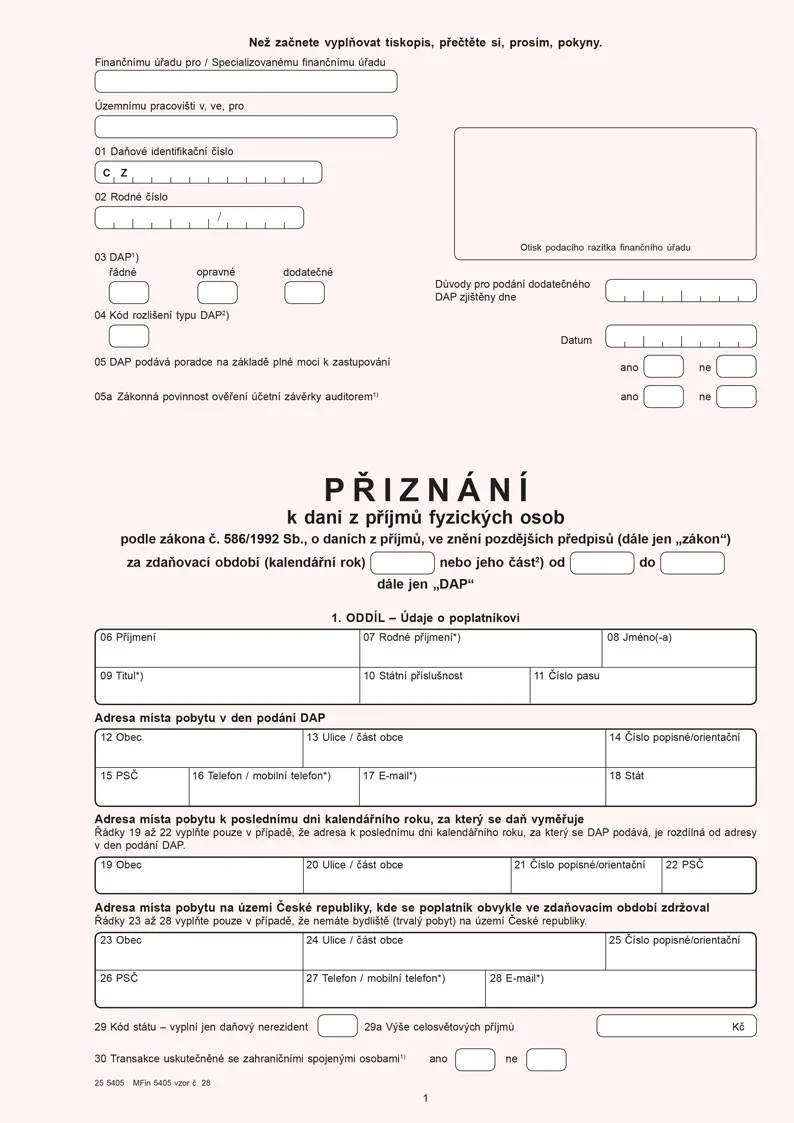

- We specialize in tax refunds from the Czech Republic, Austria and Germany.

- Contact us by email or phone

Work abroad tax return for 2022

Income from abroad

- If you worked as an employee in England, Ireland, Austria, Germany, the Netherlands, the Czech Republic and others, you are obliged to file a tax return in Slovakia as well (type A)

- For babysitters in Austria (Form type B)

- We will take care of your tax return for you. All you have to do is fill out our online form or contact us by email.

- Experience with more than 1000 tax returns prepared and all online

- In case of confusion, you can contact us by phone, we will be happy to advise you

Frequently asked questions

To process your tax return, just fill out our online form, where you answer the questions step by step and fill in your income data. Of course, you have the option to upload income data.

Contact us by phone at +421 902 067 075, where the exact procedure and the entry of all necessary documents will be explained to you. The advantage is also the consultation of your life situation, where we will advise you on how to best optimize your taxes.

We can send the processed tax return for natural persons in the Slovak Republic for you and you can do everything online from the comfort of your home.

Tax advice – Danovepriznanieonline.sk

Ing. Martin Vrábel

“Business is not only about business, but also about legal obligations in the field of taxes and bookkeeping. Leave it to us and devote yourself fully to your business.”

I prepare all returns personally, as a certified tax advisor registered in the chamber of tax advisors.

I have been dealing with tax returns since 2015, and during that time I have prepared more than 1,500 tax returns. In addition, I offer you tax advice for your business transactions, where you will get a legal solution with optimized tax costs.

I am also a financial analyst and keeping accounts is not only a legal obligation but also a source of information for management. I realize that it is not easy for you to provide your personal data and data about your income to an unknown person. In this way, I would also like to reveal a piece of my life so that you too know who is in charge of your tax return.