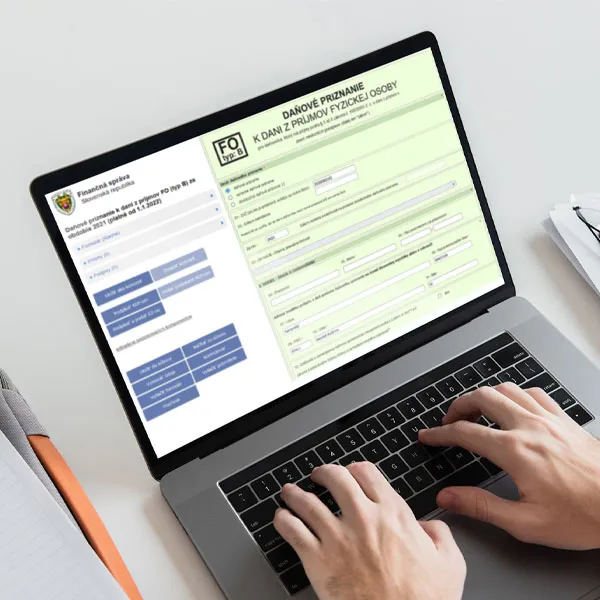

Electronic submission of a tax return for personal income tax Type A or Type B

In this section, we will show you how to easily submit (send) your completed tax return to the financial administration using electronic communication.

After preparing the tax return, we sent you, in addition to the (PDF) form, an electronic version for filing the tax return, the so-called “XML” file

Using it, you can simply import and insert your completed tax return into the electronic form, without having to write anything.

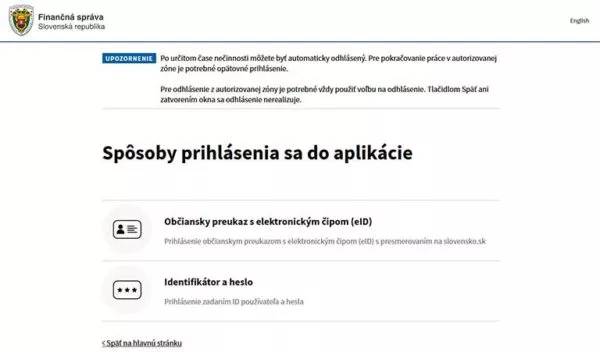

Before submitting your tax return electronically, you must first log in

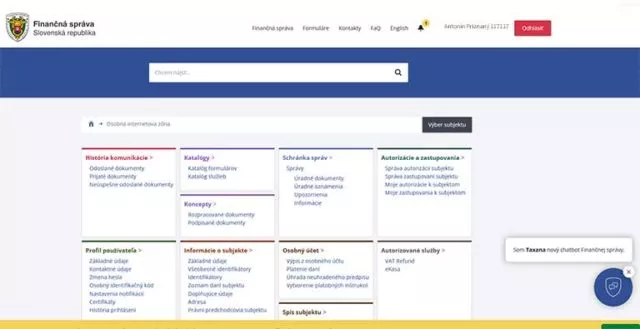

We assume that you have successfully registered and can now submit tax returns electronically. You must first log in on the Financial Administration page. There is a simple guide on how to log in to the financial administration portal.

You can find more information, tips and instructions regarding electronic communication and filing a tax return in the manuals and instructions section here.

The last step – Catalog of forms

After logging in, select “Catalog of forms” in the catalogs section. Subsequently, a new window will open with several electronic forms.

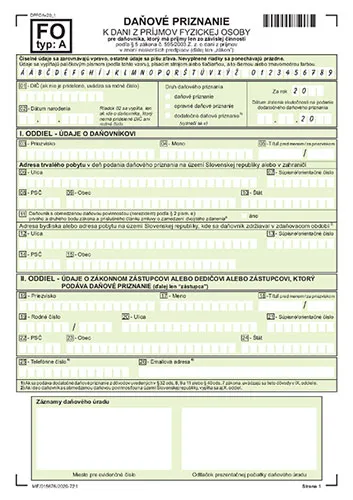

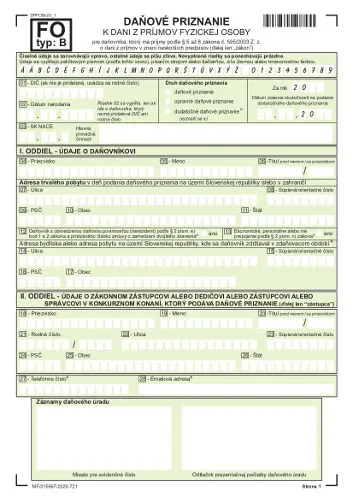

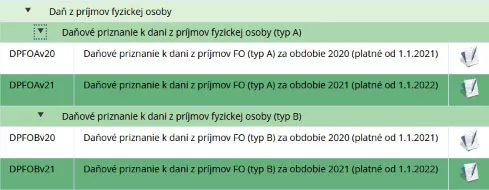

We are only interested in Personal Income Tax. We will choose, as needed, between the Type A or Type B form. Entrepreneurs will use the Type B form as usual.

Tax forms issued by the Financial Administration

We just choose the right year and click on the notebook image. Subsequently, a document with a tax return will be opened for us, which we should fill out.

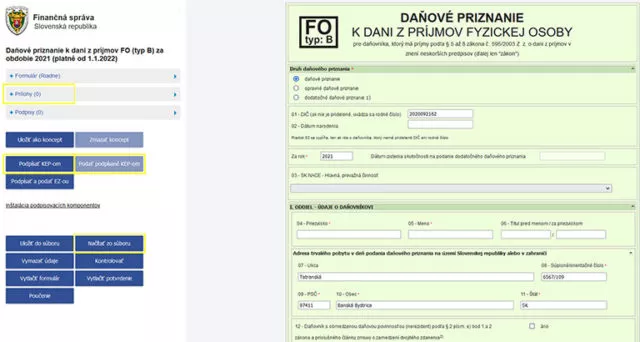

Completing the tax return

Yellow colored buttons indicate appropriate options for correct submission. In the first step, we click on load from file. We will select the XML file that we sent you with the tax return. In the second step, you insert your attachments, such as a child’s birth certificate or confirmation of taxable income from employment. We will check the form (it should be error-free). In the last step, we sign the form (by KEP) and submit the signed document – click submit signed (by KEP). If you liked the simple instructions on how to submit a tax return electronically or if you want to ask something, leave us a link.